Stable Cash Flow is King

04/30/07

Global markets were caught in a tailspin two weeks ago. The culprit was again - China. This time, the news was too good. China's gross domestic product exploded at an 11.1% annual rate, even faster than the 10.6% in the fourth quarter of 2006. The nightmare scenario that traders had to contemplate was that the People's Bank of China might have to tighten monetary policy sharply to prevent overheating. Despite a string of modest moves, liquidity and credit still are booming, which has pushed consumer-price inflation above the 3% top of authorities' comfort zone. The real inflation of course had been occurring in the Shanghai stock exchange, where a frenzy of stock buying had sent prices soaring to new highs, making the February 27th sell-off a distant memory until Thursday April 19th 2007. The Shanghai Composite closed 4.5% lower that day and investors watched anxiously the reactions of markets around the world and the reactions of their competitors next door. The Dow Jones Industrials dipped 60 points that morning in nervous trading only to recover within the first 60 minutes and closing at a new all time high that day. It seems that nothing can derail this monster of a bull market, even though this monster seems more and more like a little calf compared to the performances of the European Ochs or the Asian Dragon. Nevertheless, the Dow Jones Industrials rose in 19 of the past 21 trading days, which is only the third time in it's 110 year history. This performance may be puny by Chinese standards, but our economy is not growing at 11% either. In fact, the first estimate of U.S. gross domestic product for the 1st quarter of 2007 showed the slowest advance (1.3%) since the 1st quarter of 2003. But even that lower than expected number did not prevent the Dow Jones Industrials from closing at a new all time high.

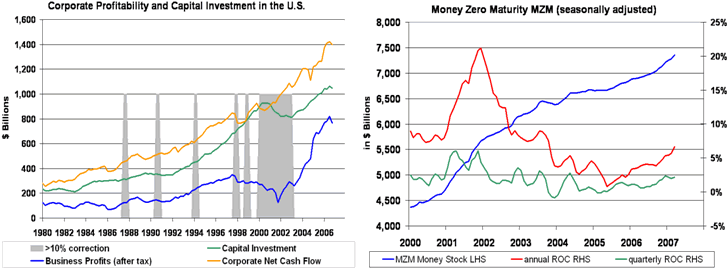

The reasons for the relentless rally have been explored many times before. In our last newsletter "Spillovers and Cycles" we examined the increasing linkage between international economies and the U.S. stock market. We also explained how the stock market's earnings yield of 6.40 % compares favorably to the current yield of fixed income instruments of 4.75%. The psychological background for the rally is unchanged from November 2006, when we explained in our newsletter "Bears are smarter but bulls make more money" how reduced volatility in economic parameters such as unemployment have lead to reduced volatility in the economy's boom and bust succession. The outsourcing of volatile manufacturing has brought more stability, not less. The above picture on the right shows how the U.S. successfully has reduced the overall volatility of available jobs by outsourcing the most volatile part, the production process, to other countries. Decreasing volatility here leads to increasing predictablity of future cash flows for households and corporations. In fact, "the stock market has been such a consistent generator of cash flow, it's become a yield engine that's quite similar to the bond market," says Dean Curnutt in Barron's this week. The stock market and its future earnings-stream as a yield engine illustrates, why big capitalization stocks have recently outperformed their smaller brethren. On one hand, their earnings benefit from a falling dollar more than the more domestic small cap companies, on the other hand their earnings-stream in a world of higly leveraged transactions becomes also more valuable to leveraged players. The picture on the left below shows corporate business profits (after tax), corporate net cash flow and capital investments including equipment and software. It shows that outsourcing of manufacturing has reduced the employment and economic volatility and in turn lead to an explosion in corporate profits, which in turn lead to a rising stock market in this country. U.S. Companies are four times more profitable today than they were at the bottom of the recession in 2002. Profit margins are at all time highs because companies can use their balance sheets more effectively since the volatility of the past two business cycles has been markedly reduced. Profit margins as a percentage of GDP should come back down as our economies go through their mid-cycle slowdowns. After all, corporate profits have historically been one of the first variables of adjustments in our economic cycles. But having said that, the "mean" to which profits revert to may be much higher than some expect. Indeed, while profits as a percentage of GDP cannot rise forever, we might have witnessed a structural shift higher in corporate profitability.

"Animal Spirits"or Investors Propensity to Take and Accept Risks

GaveKal expressed this phenomenon of exploding profits in the U.S. as follows: "With ever-growing shareholder activism, and ever-improving management techniques, an increasing number of companies have become parsimonious with their capital spending. Capital is only deployed on projects which are deemed to bring returns over a certain threshold. Functions in which the company does not add value are either shut down, or spun off and sold to other investors better able to generate value. In the US, what matters first is profits and returns on invested capital. Employment then comes as a natural consequence of the companies' profit seeking activities."

GaveKal explains all this in "Our Brave New World" with stunning clarity. Read it! It especially clarified to me, why so many smart investors did not believe in the rally of the last 2,000 Dow points. They are sceptical of the sustainability of profits and did not see the interconnectedness (good and bad) of world economies and markets. Therefore they are still not convinced of this rally because they now see declining profitability as can be seen in the picture above to the left. The 4th quarter of 2006 shows a decline from the third quarter 2006. While this is a trend to be monitored, liquidity as expressed in U.S. Money Stock (right picture above) increased more than proftability declined. Combined with stock buybacks and takeover activity, which in February alone amounted to a combined $55 billion, the net effect is a reduced amount of shares chased by ever more investment dollars. My back of the napkin calculations show that the US stock market capitalization of $15 trillion is currently being reduced by 4.5% annually just through buyback and M&A; activity alone. Meanwhile the US money stock has been increasing at an accelerating rate since 2005. For all these reasons I have no choice but to join Jim Cramer in his mad bullishness: "Dow 14,000 is coming your way soon!"

Hermann Vohs

"Most economists use statistics like drunks use lampposts: for support more than for light."

Winston Churchill