Oil Prices are Rising Again

03/31/07

Geoplitical risks are reappearing after an almost year long hiatus. The conflict between Israel and its neigbors continued, the war in Iraq descended into an even uglier civil war, Afcrica's rulers make the exploitation and murder of their citizens a blood sport but investors around the globe seemed oblivious to all of it thanks to "liquidity". I will not try to argue about the correct definition of liquidity (Henry Kaufmann does that more convincingly) but it seems that the perception of geopolitical risk is coming back to the oil markets. First Iran seized 15 british sailors from the Shatt al Arab waterway south of the Iraqi city of Basra. Teheran claimed the patrol encroached on its territorial waters in an act of "blatant aggression". Then, on Tuesday night, rumours were circulating that Iran had fired on U.S. Navy warships. Oil prices spiked within minutes by over $5.00. The important part here was not whether the rumors were true or not but the reaction of crude oil prices to the mere possibility of an armed conflict so close to Iraq's most important tanker terminals. It seems that the oil markets are teetering on the edge again. Let's see if this is justified.

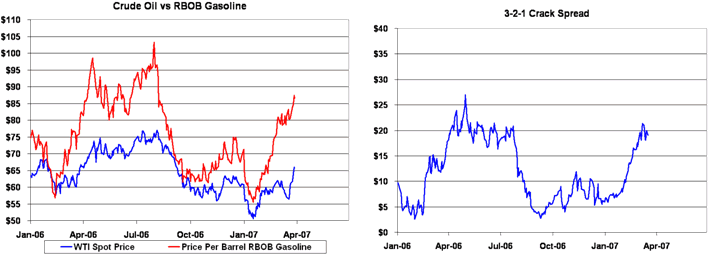

Crude Oil vs RBOB regular Gasoline Gross Processing Margins (Crack Spread)

The picture on the left shows that gasoline prices have been rising faster that crude oil prices since January 2007. The red line shows the barrel equivalent of the gasoline markets, the blue line shows the spot price of West Texas Intermediate crude oil. You can see that the product prices (output prices) have been rising faster than the crude oil prices (input prices). The spread between the raw material oil and the products (mainly gasoline and heating oil) is called the crack spread (right picture). The term "crack spread" refers to the spread, or margin, that a refinery can earn by cracking a barrel of oil into refined products. For simplicity, most refiners wishing to hedge their price exposures have used a crack ratio usually expressed as 3:2:1. The 3 2 1 ratio approximates the real world ratio of refinery output where 3 barrels of crude oil are cracked into 2 barrels of unleaded gasoline and 1 barrel of heating oil. As you can see in the pictures, the crack spread lifted off right at the beginning of the year, when crude oil prices were still in a free fall. The reduction in gasoline production stemming from refinery maintenance and unplanned outages as well as reduced imports of gasoline led to tightness and rising prices in the gasoline markets, which led to widening crack spreads and attractive yields for refiners. For the eighth consecutive week, gasoline prices increased, rising 3.3 cents to 261.0 cents per gallon for the week of March 26, 2007. Prices are now 11.2 cents per gallon higher than at this time last year. All regions reported price increases. While gasoline prices entered a bull phase some 3 months ago, it is the geoploitical tensions that alert the media and magnify domestic bottlenecks in this country.

Now we understand why Crude spiked another 5.6% in the week after rising 8.9% last week. A barrel of light, sweet crude closed Friday slightly negative at $65.87 after seven straight days of gains. While the U.N. expressed "grave concern" over the detention of the 15 soldiers, it failed to "deplore" the action or insist on their immediate release as Britain had insisted. Nevertheless, upward pressure on crude prices generated by the issue may be tapped out for now. If Iran was to hand over the soldiers without the standoff escalating, crude prices would probably fall by $2.50 $3.00. Elsewhere, Nigerian presidential candidate and opposition leader Adebayo Adefarati died overnight in a hospital in the Southern coastal region of Ondo. Adefarati, age 76, was the chief of the Alliance for Democracy party. His death is sparking greater uncertainty about the way the April presidential elections will be handled. Violence between the government of current president Olusegun Obasanjo and various rebel groups has escalated sharply since the first of the year. The majority of the violence has occurred in Nigeria's delta region where the country's vast oil and gas producing regions are located. Rebels have been kidnapping foreigners in the region and holding them for ransom. Obasanjo is flooding the region with troops, in part to restrain the rebels, but also to quash political opposition during his re election effort. If violence increases in Nigeria in the weeks leading up to the elections, it will most likely generate further stress on crude supplies.

The chart above shows the crude oil production of the U.S., the Persian Gulf States, OAPEC (=Organization of Arab Petroleum Exporting Countries) and OPEC (=Organization of the Petroleum Exporting Countries). The countries around the Persian Gulf have not been able to increase their collective production for the last two years. It seems that supply from the Persian Gulf region will no longer rise. The once richest oil fields that currently produce one quarter of the worlds daily output are levelling off. Depletion in those oil fields forces the owners to invest more and more capital to maintain a steady rate of production. It seems that the low hanging fruit have been harvested. At the same time, the demand for oil is continuously increasing. China's and India's growing middle class want cars and air conditioning. Both countries will increase their oil consumption for the foreseeable future. The margin of error in the global oil markets is shrinking and prices start to reflect the increasing certainty, that a reliable supply of oil will come at an ever increasing cost. Oil service stocks should be the beneficiaries. After almost a year of consolidation it seems that the next leg of this energy bull market is upon us.

Hermann Vohs