Liquidity Aplenty

03/15/07

The liquidity crunch that many prognosticators have been predicting is not happening. The hedge fund Farallon rescued Accredited Home Lending by providing a $200 million loan. The bet is that the loan will enable this sub-prime lender to survive the storm. Farallon gets 13% annual interest on the five-year loan plus a payment of 3.3 million in-the-money warrants. On the warrants, which give Farallon the right to buy the stock at $10 per share, the hedge fund already made about $2.6 million, or 8%, just on Tuesday. That's the "in-the-money" part as the stock opened Tuesday over $10 per share and closed up 20.3% at $10.77. The loan to an endangered stock species shows, if anything, that there are still substantial sums of risk capital available.

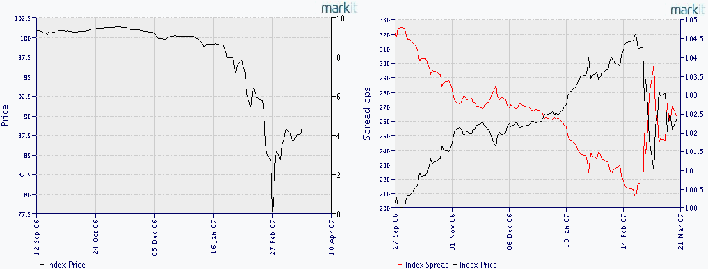

Asset Backed Index "Home Equity BBB-" (01/06) Dow Jones North American High Yield Index

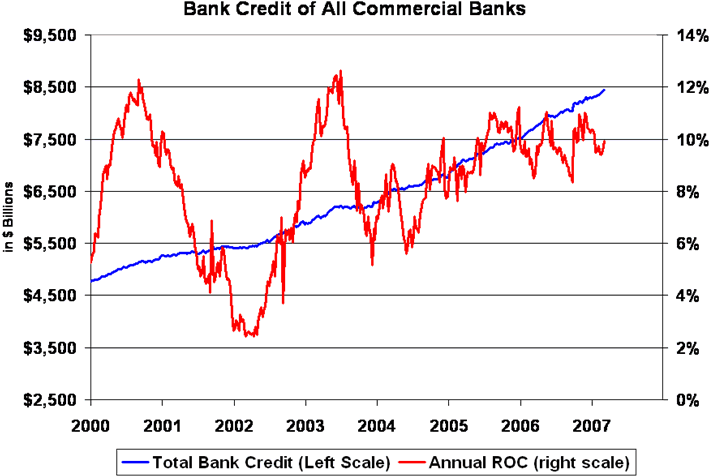

Spreads, or risk premiums, are also still tight in high-yield bonds. The left picture above shows the ABX.HE (Home Equity) with the lowest credit rating of BBB-, which is part of the "US Asset Backed Credit Default Swap Benchmark Indices". The price of the index recovered almost 50% of the early March sell-off. The chart to the right shows the Dow Jones CDX.NA.HY Index (the "HY Index") which is composed of 100 non-investment grade entities domiciled in North America. This index also attracted bargain hunters which lifted the prices off the bottom. The sub-prime lending crisis seems to dissipate slowly but steadily. The credit spreads are still within shouting distance of their historic lows from mid-February and indicate ample liquidity but certainly no credit crunch. Tony Crescenzi tried to determine if the country has entered a credit crunch by looking at data, published by the Federal Reserve every Friday. He says: "The data are an excellent gauge of whether any change in lending conditions is occurring. In this report, the Fed sums up the total amount of money extended by the nation's commercial banks to individuals, businesses and government entities via loans, leases and securities purchases. The data are comprehensive, meaning that if the problems in the subprime sector are broadening out, this will be obvious in the data. The newest data released Friday squash the idea that a credit crunch is developing in response to recent subprime problems. The Fed's data show that bank credit expanded strongly in the week ended March 7, increasing $23.9 billion to $8.437 trillion. The rise follows other large gains over the previous five weeks, which saw bank credit expand at a 13% annual rate, which is faster than last year's gain of 11% and 2005's gain of 10% Interestingly, recent increases in bank credit have been partly the result of steady increases in real estate loans, which reached a record $3.381 trillion in the latest week. In addition to these data,

it is notable that bond issuance has been very robust over the past two weeks, with issuance running several times the normal levels. Hence, many entities are looking for money (many of these have been financial companies), and investors have been very willing to give it to them."

The Federal Open market Committee is concluding its meeting tomorrow. The Fed is unlikely to cut the fed funds rate or change its bias at the conclusion of Wednesday's Federal Open Market Committee meeting because evidence of loose liquidity is still abundant in today's financial marketplace -- even with the subprime problems and house price deflation and, yes, even with slower economic growth. While traders want a rate cut and think it will help the market, a fed funds rate cut may only exacerbate inflation problems. Liquidity is usually the precursor to rising inflation, to paraphrase Milton Friedman. Higher inflation certainly won't help the subprime borrowers suffering from higher loan payments or negative equity in their homes. That said, the Fed is very aware that it must retain its credibility as being both thoughtful about economic concerns and vigilant on inflation. I believe, like most economists, that the Fed will keep its policy statement similar to its most recent one. They'll say the economy has softened a bit, but they'll maintain their upward risk assessment on inflation.

Equity markets meanwhile rallied into the Fed meeting, hoping that Bernanke would produce the usual "Bernanke Bump" just like in all prior meetings after they stopped raising rates in June 2006. While it seems likely, that the chairman will be able to appease most market participants again, I must admit that the markets feel eerily calm and it sometimes reminds me of the deafening silence in the eye of a hurricane. While there is no credit crunch as many would have us believe, it still is possible that equity markets will have to test the recent lows again. I would keep time frames short and tread carefully in the next couple of weeks.

Hermann Vohs