Credit Creation and Destruction

02/15/07

Negativity sells. The news that the British Banking Conglomerate HSBC Holdings had to incur a bad debt charge which was $1.8 Billion higher than had been expected, rocked the financial world. HSBC's US subsidiary had purchased U.S. mortgage securities, particularly loans to borrowers of less than top credit, "subprime mortgages", which had not performed in the most stellar fashion, meaning that they fell behind. That's why they are called "subprime mortgages". Markets reacted immediately and sold off any stock with even the slightest relation to subprime lending. The bears, who had been warning about this for the past three years and who had to witness for an agonizing 36 months how the markets rose without them, finally had their day in the sun and that "I told you so" experience. The media aided and abetted with more or less glee:

"Rising Mortgage Defaults: Another Problem For Real estate" CNNMoney

"Outlook For Subprime Lenders Seen As Tough" Forbes

"Mortgage Hot potatoes" WallStreet Journal

"Subprime Woes Subdue Some Winners" Business Week

"Another subprime lender, RseMAE, files for bankruptcy" MarketWatch

The problem I have with this sensationalism is that it had announced itself for the last couple of months and despite the hoopla and the breathless reporting, it probably will have only limited repercussions for equity markets and the economy. In other words "Get a Live!".

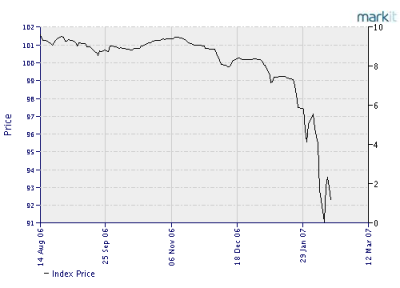

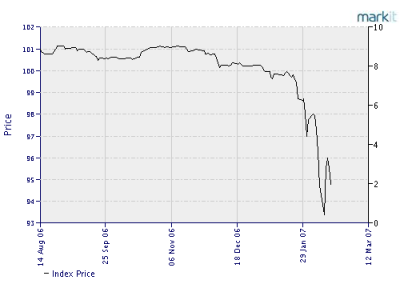

Asset Backed Index – Home Equity BBB- (01/06) Asset Backed Index – Home Equity BBB (01/06)

The two charts above show the latest creation in this brave new world of financial engineering. Let me explain: Indices on Asset Backed Securities (ABS) constitute pools of loans, which have been sold to investors. Several of these pools are pooled again to form the respectives Indices. The two charts above are part of the ABX family of Indices, which carry the name "The New US Asset Backed Credit Default Swap Benchmark Indices". The ABX.HE for Home Equity will be followed shortly by ABX.CC for Credit Cards, ABX.SL for Student Loans and ABX.AU for Auto Loans. The above pictures show the ABX.HE with the lowest credit rating of BBB- and the second lowest credit rating of BBB. As you can see above, trouble in Mortgage Land announced itself some 3 weeks before HSBC had to confess that it had "unexpected" mortgage writedowns of $1.8 Billion. Markets are smart and they usually telegraph when something is afoot. All of the hyperventilating over subprime lending problems was really unnecessary, guys. The decay in the securitization markets became already obvious in December of 2006. On November 27, 2006 the index publisher announced an interest shortfall on two bonds, underlying the ABX.HE BBB- and ABX.HE BBB tranches. By the time the newsmedia started to report the event, the damage had been done and the first bargain hunters prepared themselves to stepp up and take advantage of the panic that sure was to follow. Look at the charts so that this may serve again as an illustration of the principle "Sell the Rumor" (December 2006) and "Buy the News" (February 2007). The media reports implied that the entire mortgage/banking sector was in trouble. What I am telling you is that all these tranches from AAA on down to BBB- have their own cash flow allocations. In other words, before the A piece gets hurt, the A- piece must get hurt. Before the A- piece gets hurt, the BBB+ piece must get hurt. Before the BBB+ piece gets hurt, the BBB piece must get hurt. Before the BBB piece gets hurt, the BBB- piece must get hurt. Finally, before the BBB- piece gets hurt, the equity/overcollateralization piece must get hurt. This is the beauty of today's financial engineering. Risk and cash flow are compartmentalized and just like bulkheads in a ship, serve as protective barriers against desaster. The ABX.HE BBB- tranche, having the lowest credit rating with the least collateral to cover payments, lost 15% in two months. The ABX.HE AAA tranche, having the most collateral to cover payments, had no discernable price movement at all. So let's all get over the fact that high risk borrowers pay higher interest rates because they sometimes can't pay you back. Lenders get paid handsomely for the risks they are taking and the only consequence that I can see is that lending standards will become tighter. That's it.

A spillover effect into other fixed income markets therefore could and should not be observed. The indices for the riskiest debt securities, the High Yield index and the Emerging Markets Index did not show any deterioration whatsoever. On the contrary, they rose in value and the spread to comparable riskless 5 year government notes continued to tighten to a historic low of around 200 Basis Points (BPS, red line) and 100 Basis Points respectively. Tony Crescenzi was again my favorite commentator when he reviewed the latest report of the Federal Deposit Insurance Corporation (FDIC), which should know a thing or two about lending and banking.

Crescenzi wrote: "Each quarter, the FDIC discusses its "Problem List," which reflects those banks that the FDIC sees as having difficulties. In the FDIC's latest Quarterly Banking Survey for the end of September 2006, the FDIC notes that there were 8,743 insured institutions reporting results down from 8,778 reporters as of June 30. No FDIC-insured institution failed during the quarter, extending the record-setting streak of no failures to nine quarters. As a further sign of industry health, the number of institutions on the FDIC's "Problem List" declined from 50 to 47, and assets of "problem" institutions shrank from $5.5 billion to $4.0 billion. Both the number and assets of "problem" institutions were at historical lows."

The bears want you to believe that they know more than the rest of us. Not true. Permabears see danger everywhere and opportunity nowhere. Trust me, the sky is not falling and if it should fall, you can bet that not one of the bears that have been crying wolf forever, will see it coming and tell you to run for the hills. The free markets system has created risks and opportunities. Problems in the subprime market might create opportunities more than they create risk. The stock market may have to digest recent gains, yes, but that is no reason to panic.

Hermann Vohs